10 min read

Unlocking Support: Essential Private Elder Care Services for Seniors

Why Understanding Your Options Matters Now Private elder care services are non-medical and specialized support options that help seniors live...

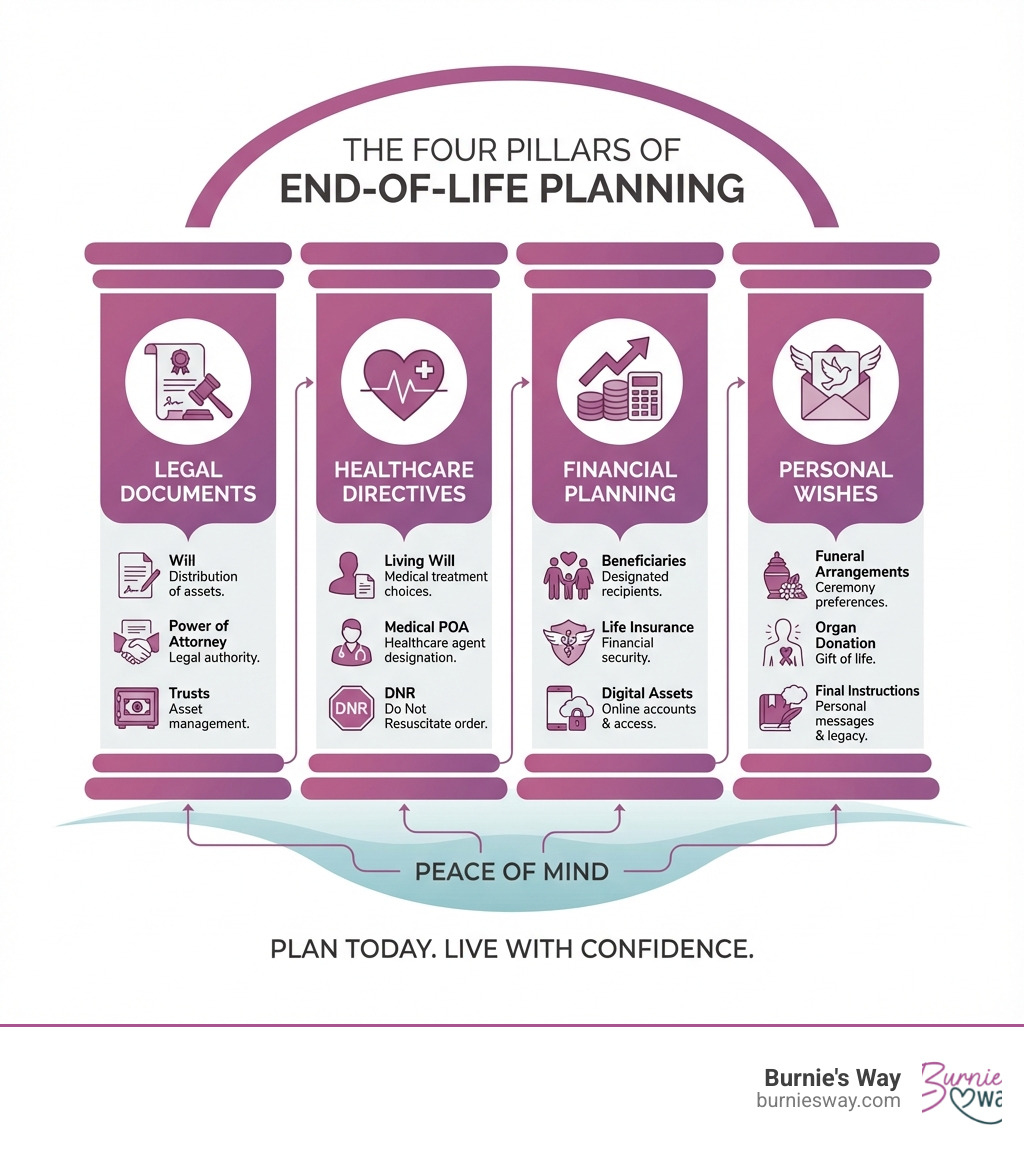

End-of-life planning is the process of making decisions and organizing your affairs for when you pass away. While it's a difficult topic, it's one of the most important gifts you can give your loved ones. Studies show that when these conversations happen, surviving family members report less guilt, less depression, and an easier grieving process.

Quick Answer: What Does End-of-Life Planning Include?

Without a plan, your family faces a mountain of stressful decisions. They are left to wonder about your wishes for medical care, finances, and final arrangements, which can create confusion and conflict.

The truth is: end-of-life planning isn't about death—it's about living with confidence that your wishes will be honored and your loved ones will be cared for.

By creating a plan, you relieve your family of an administrative burden, ensure your assets go where you want, and make your healthcare preferences clear. This gives everyone involved—including yourself—genuine peace of mind. This guide will walk you through every essential component in clear, actionable steps.

Legal documents are the bedrock of your plan, translating your wishes into legally binding instructions. They ensure your voice is heard and protect your loved ones from disputes and administrative headaches. The essential documents include a Last Will and Testament, Powers of Attorney, and potentially a Revocable Living Trust. While online templates exist, consulting with a qualified legal professional provides peace of mind. Organizations like the American Bar Association, the National Academy of Elder Law Attorneys, and the National Elder Law Foundation can help you find expert guidance.

Your Last Will and Testament is a cornerstone of end of life planning. It's a legal document outlining how your assets (your "estate") will be distributed. A will allows you to:

For a will to be valid, it must meet state-specific requirements. Generally, it must be in writing, signed by you (while of sound mind and over the age of majority), and witnessed by two people who are not beneficiaries.

A Power of Attorney (POA) addresses what happens if you're alive but unable to make decisions. It gives someone you trust (your "agent") the authority to act on your behalf.

You can appoint the same person for both roles or different individuals based on their strengths.

A Revocable Living Trust (RLT) is another powerful tool for managing assets and potentially avoiding probate court.

| Feature | Last Will and Testament | Revocable Living Trust (RLT) |

|---|---|---|

| Asset Distribution | Dictates asset distribution after death. | Holds and manages assets during life and distributes after death. |

| Probate | Generally goes through probate court. | Avoids probate for assets held within the trust. |

| Privacy | Becomes public record during probate. | Remains private. |

| Effectiveness | Effective only upon death. | Effective immediately upon creation. |

| Incapacity | Does not manage assets during incapacity. | Provides for asset management during incapacity. |

A Revocable Living Trust allows you to transfer assets into the trust while you're alive, maintaining full control as the trustee. Upon your death or incapacitation, a successor trustee manages the assets according to your instructions, usually without court involvement.

Pet Trusts ensure your companions are cared for. A pet trust designates a caretaker and provides funds specifically for their care. This can be a clause in your will or a separate trust. The ASPCA offers valuable information on this topic.

Proactive advance care planning is an act of consideration for your family. It's about making your healthcare decisions known now, so if a crisis strikes, your wishes are respected and your loved ones aren't left guessing. Open discussions with doctors and family are practical steps and opportunities for connection. Resources like PREPARE for Your Care and The Conversation Project offer excellent guides to help you begin.

These legal documents are your voice when you cannot speak.

End of life planning should include your preferences for housing and care. Do you wish to "aging in place" at home, or would you prefer an assisted living facility, nursing home, or hospice care if your needs change? Discussing these preferences with your family is crucial. While we are not a caregiving or healthcare provider, Burnie's Way can act as a personal concierge and companion. We help our members coordinate personal support and routines, connecting them with trusted resources to explore various housing and care options. Our goal is to help you live the way you want, with support that gives you and your family peace of mind.

Organ, tissue, or whole body donation is a meaningful way to leave a legacy. This aspect of end of life planning allows you to give the gift of life or contribute to medical science.

Becoming a registered donor is often as simple as checking a box at the DMV or registering online through OrganDonor.gov. It's vital to communicate your decision to your family, as they may be asked for consent. Even with certain medical conditions, you may still be eligible to donate tissue or your whole body for research.

One of the greatest gifts you can give your loved ones is an organized estate. Preparing and organizing important records in one place reduces stress, prevents financial confusion, and ensures your wishes are carried out smoothly. We recommend creating a master list of all your accounts, policies, and documents, and storing it securely in a fireproof box or digital vault.

Navigating financial assets is a critical part of end of life planning. A key distinction to understand is between "probate" assets (which go through court) and "non-probate" assets (which transfer directly to beneficiaries).

Beneficiary Designations are incredibly important for non-probate assets like:

It's crucial to review your beneficiaries regularly, especially after life events like marriage or divorce. Without a named beneficiary, these assets may go through probate. Life insurance also plays a vital role, providing funds for final expenses or financial stability for your family. At Burnie's Way, we understand that keeping track of all these financial details can feel overwhelming. While we don't provide financial advice, we can help our members stay organized by assisting with document management and connecting them to trusted financial advisors or estate attorneys.

In our increasingly digital world, our online presence is a significant part of our legacy. These "digital assets" require careful consideration in your end of life planning. Without a plan, your digital footprint can become a source of frustration for your loved ones. We recommend creating a comprehensive inventory of your digital assets, including:

Consider using a secure password manager and designating a "digital executor" you trust to manage these accounts according to your wishes. Provide clear instructions on whether to delete, memorialize, or transfer each account.

Planning your funeral or memorial service is a compassionate act of end of life planning. By making these decisions in advance, you lift a significant burden from your family, allowing them to focus on healing. It also ensures your final farewell reflects your personality and values. Pre-planning can also offer financial benefits by locking in costs. The Federal Trade Commission offers excellent tips on this topic.

One of the first decisions is choosing between burial and cremation.

Regardless of your choice, document your memorial preferences: a religious service, a celebration of life, specific music, or readings.

To pay for a funeral, you can use pre-paid funeral contracts, life insurance, savings, or veterans benefits. The Funeral Rule, enforced by the FTC, requires funeral providers to give you an itemized price list, ensuring transparency and helping you compare costs.

The hardest part of end of life planning is often just getting started. Here's a simple checklist to help you begin:

End of life planning is an ongoing process. Review your plan annually and after any major life event, such as:

For a more comprehensive guide, you can download a printable end-of-life planning checklist.

We understand that you might have more questions as you steer this important process. Here are some common inquiries we encounter:

If you die without a will ("intestate"), state laws dictate how your assets are distributed. This process, called intestate succession, means your property goes to your closest relatives in a legally defined order, which may not reflect your wishes. A court will appoint an administrator to manage your estate and decide who raises your minor children. This can lead to family disputes and a lengthy, public court process.

The need for a lawyer in end of life planning depends on your situation's complexity.

Starting conversations about end of life planning is a loving act that makes grieving easier for survivors.

End of life planning is truly an ultimate gift—a testament to your love and foresight. By taking the time to organize your affairs, articulate your healthcare wishes, secure your digital legacy, and pre-plan your final arrangements, you empower yourself and provide invaluable peace of mind to your loved ones. You reduce their administrative burden, prevent potential disputes, and ensure that your life and legacy are honored according to your deepest desires.

At Burnie's Way, we understand that managing the many facets of daily life, including the important task of getting your affairs in order, can be challenging. For seniors seeking personal support to manage daily life and get their affairs in order, Burnie's Way provides compassionate assistance and coordination. We help our members organize their documents, connect with trusted professionals, and coordinate routines that support their independence and well-being, allowing them to live confidently and comfortably at home.

10 min read

Why Understanding Your Options Matters Now Private elder care services are non-medical and specialized support options that help seniors live...

12 min read

Why Finding the Right Support Matters Most Reliable home care starts with understanding what you need and knowing where to find trustworthy help....

12 min read

The Comfort of Home and the Path to Independence Home care solutions are the services and support that help aging adults live safely, comfortably,...