12 min read

Mastering Daily Life: A Comprehensive Look at ADLs

What Daily Living Assistance Really Means Daily living assistance refers to support that helps people accomplish the everyday tasks needed to live...

12 min read

Sydney Giffen

:

Updated on February 20, 2026

Sydney Giffen

:

Updated on February 20, 2026

Long term care is a range of services and supports designed to help people meet their personal care needs when they can no longer perform everyday activities on their own. This might include help with bathing, dressing, meal preparation, medication reminders, or managing household tasks.

Quick Definition:

Long-term care isn't just about medical treatment. It's about maintaining independence, safety, and quality of life when daily tasks become challenging. Whether someone needs help after a stroke, is managing Alzheimer's disease, or simply finding that age is making everyday activities harder, long-term care provides the support to keep living with dignity.

The need for this support can come suddenly—after a hospital stay or health emergency. Or it can develop gradually as someone ages or a health condition worsens. Either way, understanding your options early makes all the difference.

This guide walks you through everything you need to know: what long-term care really means, where it can be provided, how much it costs, and how to plan ahead. Whether you're thinking about your own future or supporting an aging parent, you'll find clear answers to help you make confident decisions.

Long term care terms at a glance:

When we talk about long term care, we're referring to a broad spectrum of services and supports designed to assist individuals who can no longer perform daily living tasks independently due to chronic illness, disability, or the natural process of aging. This assistance isn't always medical in nature; often, it focuses on personal support and daily living help. Think of it as a helping hand with the everyday things that keep our lives running smoothly and independently.

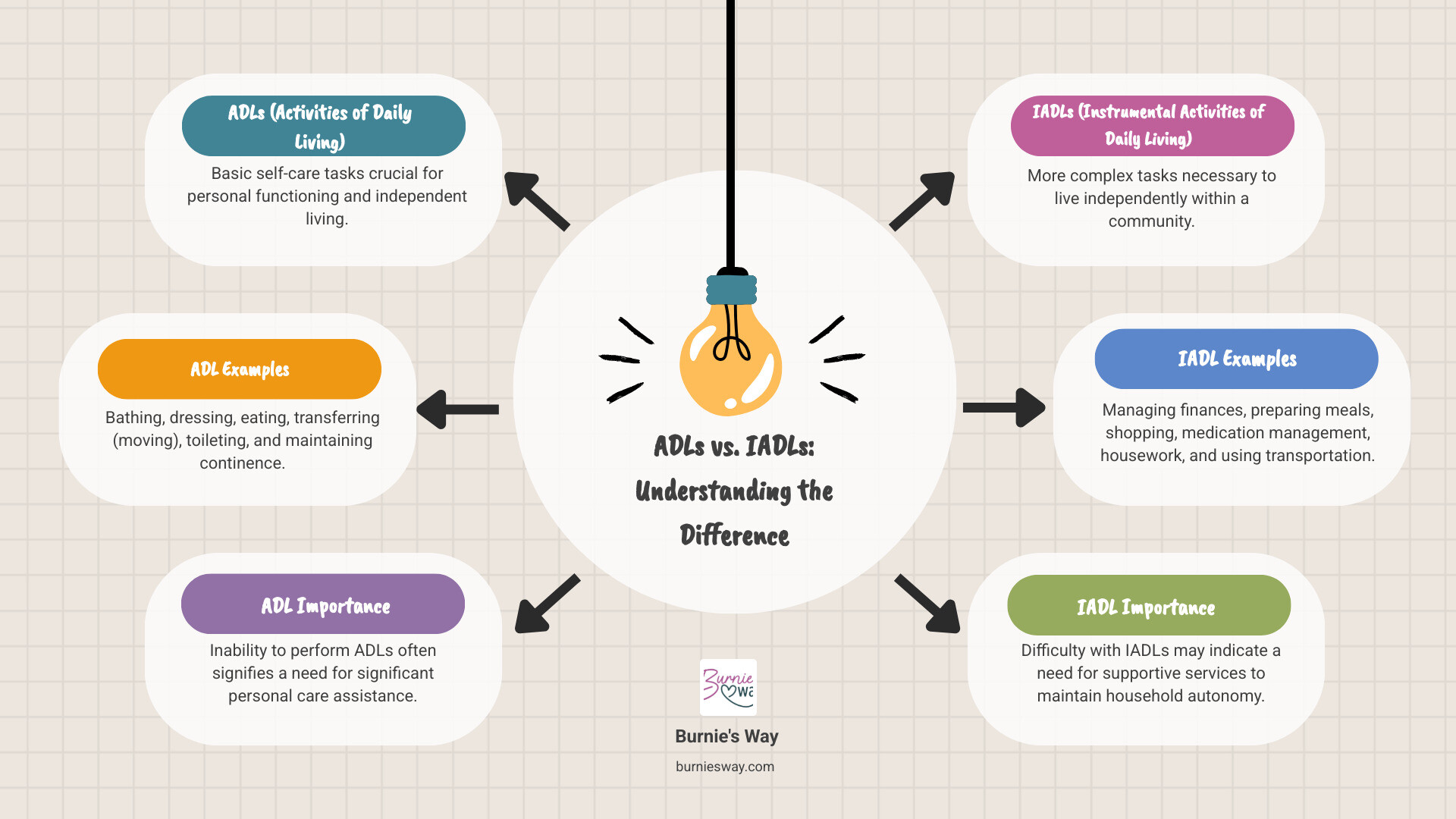

The core of long term care often revolves around what experts call Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs). ADLs are basic self-care tasks like bathing, dressing, eating, using the restroom, and moving from a bed to a chair. IADLs are more complex tasks essential for independent living, such as managing finances, preparing meals, driving, light housekeeping, and managing medications. When someone needs consistent support with two or more of these activities, they typically qualify for long term care services. You can learn more about these distinctions at Activities of Daily Living: What Are ADLs and IADLs?.

Who needs this kind of support? The answer is more widespread than many might imagine. While it's often associated with aging adults, long term care is also crucial for those with chronic conditions, individuals recovering from a serious injury or illness, or people living with disabilities. The need can arise suddenly, perhaps after an unexpected stroke or a significant fall, requiring immediate and intensive support. Other times, it develops gradually, as an existing health condition worsens or as the effects of aging make daily tasks increasingly difficult.

Consider these compelling statistics:

Whether it's a gradual need for a little more help around the house or a sudden requirement for comprehensive support, long term care aims to ensure that individuals can continue to live as independently and comfortably as possible.

One of the most important aspects of long term care is understanding that it’s not a one-size-fits-all solution. Support can be provided in a variety of settings, each designed to balance independence with necessary assistance and improve the overall quality of life. The ideal setting depends on an individual's specific needs, preferences, and the level of support required.

The goal is always to empower individuals to live safely and independently for as long as possible, in an environment that feels comfortable and familiar. From the comfort of one's own home to specialized residential communities, the options are diverse.

For many, the dream is to "age in place"—to remain in their own home and community as they grow older. This desire is deeply rooted in comfort, familiarity, and a sense of continuity. Fortunately, at-home support has become a cornerstone of long term care, offering a flexible and personalized approach.

At-home support often begins informally, with family members, friends, and neighbors stepping in to help. In fact, studies show that a significant majority of home care is provided by loved ones without compensation. This informal network is invaluable, but it can also be emotionally and physically demanding for those providing support.

As needs evolve, professional services can complement or take over these tasks. These can range from practical assistance like home organization and running errands to more personal support and coordination. Our services, for example, focus on providing personalized support and coordination, helping clients manage their daily lives with ease and confidence. We help with things like:

We believe in enhancing independence and ensuring peace of mind, not just for our clients but for their families too. You can learn more about how we help our clients live comfortably and confidently at home by visiting More info about our services.

Beyond the home, a vibrant ecosystem of community-based services offers valuable long term care support. These programs are designed to help individuals remain connected to their communities, participate in social activities, and receive necessary assistance without residing in an institutional setting.

Some common community-based services include:

These services play a crucial role in preventing isolation, promoting well-being, and allowing individuals to continue living at home for longer. If you're looking for resources in your area, the Eldercare Locator is an excellent starting point, connecting older Americans and their supporters with trustworthy local resources. Additionally, your local Area Agency on Aging can provide custom recommendations and insights into available services in your community.

When at-home or community-based support is no longer sufficient, residential options provide a structured environment with varying levels of assistance. These facilities are designed to meet diverse needs, from those requiring minimal daily help to individuals needing extensive medical supervision.

The choice between assisted living and a nursing home depends heavily on the individual's health status, cognitive function, and the level of medical and personal support required. Assisted living generally offers more independence and a homelike environment, while nursing homes prioritize comprehensive medical care. Understanding these distinctions is crucial when exploring residential long term care options.

Let's face it, discussing money isn't always fun, but when it comes to long term care, understanding the financial realities is paramount. The costs associated with support services can be substantial, making financial planning and asset protection critical steps for anyone considering their future needs. Without adequate preparation, the expenses can quickly deplete savings and create significant burdens for families.

Thinking ahead allows us to explore various funding avenues, from personal savings to insurance and government programs, ensuring that choices about our future support are driven by preference, not financial constraint.

The costs of long term care can vary dramatically depending on the type of service, geographic location, and level of assistance needed. However, one thing is consistently clear: these services are expensive. It's a common misconception that standard health insurance or Medicare will cover the bulk of these costs, but as we'll see, that's rarely the case.

Let's look at some average annual costs in the United States, based on 2019 data, to give us a clearer picture:

| Type of Long-Term Care Service | Average Annual Cost (2019) |

|---|---|

| Private Nursing Home Room | $102,200 |

| Assisted Living | $48,612 |

| Home Health Care (44 hr/week) | $52,654 |

These figures highlight that even in-home support services can exceed $52,000 annually, while residential care, such as a private room in a nursing home, can easily top $100,000 per year. These are not small sums, and they underscore the importance of proactive financial planning.

Given the significant costs, how do most individuals and families manage to pay for long term care? It's often a combination of strategies.

Understanding these options and how they fit into your overall financial picture is a key step in planning. If you're wondering about the costs associated with coordinating personal support services, you can find More info about our pricing.

While personal funds and private insurance are critical, government programs also play a significant role in helping individuals cover long term care expenses, albeit with specific limitations and eligibility requirements.

Medicaid: This federal and state program is the primary payer for long term care services in the United States, especially for those with limited income and assets. In fact, 67% of all nursing home residents in the US used Medicaid as their primary source of payment. Medicaid covers a broader range of long term care services, including nursing home care and many home and community-based services (HCBS) like adult day care, personal care, and home health aides.

Benefits for Veterans: The U.S. Department of Veterans Affairs (VA) provides a range of long term care services for eligible veterans, including nursing home care, assisted living, and home-based care. Eligibility often depends on service-connected disabilities, income levels, and the veteran's need for assistance. The VA's services are designed to support veterans in maintaining their health and independence. For more information on veterans' benefits for aging adults, visit the U.S. Department of Veterans Affairs (VA) Geriatrics and Extended Care.

Navigating these government programs can be complex, but understanding their role is vital for comprehensive long term care planning.

The thought of needing long term care can be daunting, but proactive planning is one of the most empowering steps we can take. It’s about being prepared, maintaining control over our choices, and ensuring our preferences are respected down the line. Waiting until a crisis hits often leaves families scrambling, making hurried decisions under stress.

The best time to start planning for long term care is before you need it, ideally in your 50s or early 60s. This gives us the precious gift of time—time to research options, understand costs, explore funding mechanisms, and have calm, considered conversations with our loved ones. It's about building a roadmap for our future, ensuring our independence and quality of life are preserved.

At Burnie's Way, we understand the importance of thoughtful preparation. Our approach is designed to help you steer these discussions and organize your life in a way that supports your future needs. Find How We Work to see how we empower our clients to live confidently.

Effective long term care planning involves several interconnected steps:

You don't have to steer the complexities of long term care planning alone. A wealth of resources and organizations are available to provide guidance and support:

At Burnie's Way, we pride ourselves on being a central point of contact for our clients, helping them find and coordinate access to these valuable resources. We act as your personal concierge, ensuring you have the information and connections you need to make informed decisions and live life on your terms. For more common questions, check out our FAQ.

No, most regular health insurance plans, including Medicare, are not designed to cover ongoing personal support or custodial care. These plans primarily focus on acute medical needs, such as doctor visits, hospital stays, and short-term rehabilitation following an illness or injury. Long term care, which involves assistance with daily activities like bathing, dressing, or meal preparation, is typically excluded from standard health insurance coverage. This is why specialized long term care insurance or other financial planning is often necessary.

The main difference lies in the level of care provided. Assisted living communities are designed for individuals who need help with daily activities (ADLs and IADLs) but do not require 24/7 skilled nursing care. They emphasize independence, offering private living spaces, meals, social activities, and personal assistance. Think of it as a supportive residential environment. Nursing homes, on the other hand, provide a higher level of medical care and supervision. They are for individuals with complex health conditions, severe cognitive impairments, or those needing intensive rehabilitation, offering round-the-clock skilled nursing services. Nursing homes are more medically intensive, while assisted living focuses more on personal support and quality of life in a residential setting.

The best time to start planning for long term care is before you need it, ideally in your 50s or early 60s. This proactive approach offers several advantages:

Navigating long term care can feel like a labyrinth, but with the right information and a proactive approach, it becomes a path we can walk with confidence. We've explored what long term care truly means, the diverse settings where support can be provided, and the significant financial considerations involved. The key takeaways are clear: planning is crucial, costs are high, and options are varied.

At Burnie's Way, our mission is to empower independence and improve the quality of life for aging adults. We understand that maintaining your lifestyle and peace of mind is paramount. We don't provide caregiving or healthcare services, but we act as your personal concierge, offering compassionate support for coordination and daily life management. We help you connect with resources, organize your affairs, and ensure you're living the way you want, comfortably and confidently at home.

The journey through long term care can be complex, but you don't have to start on it alone. Let us be your trusted partner, helping you orchestrate the support you need to live a full and independent life.

12 min read

What Daily Living Assistance Really Means Daily living assistance refers to support that helps people accomplish the everyday tasks needed to live...

13 min read

What Continuous Care Services Really Mean for You and Your Family Continuous care services are specialized, short-term support designed to help...

13 min read

Why Finding the Right Support Partner Matters A caregiver matching service connects families with qualified support companions or personal...